What Happens Next if You Choose to Break Your Lease?

What Happens Next if You Choose to Break Your Lease?

Blog Article

The rental industry is obviously shifting, with more renters than actually rethinking their residing situations. Searches around “how to get out of a 1 year lease early” soared by around 70 per cent in the last year alone, sending a clear trend. Whether it's a work change, unexpected financial difficulties, or a relationship shift, your decision to separate a lease isn't one to get lightly. Knowledge the important facets at enjoy can save you from sudden economic and legitimate headaches.

Early Terminations on the Rise

A recent evaluation across major US towns unveiled that around 18 percent of tenants contemplate breaking their lease before the total term ends. That mirrors broader changes in employment, lifestyle, and actually psychological wellness priorities. Information also demonstrates younger visitors, especially those outdated 18 to 34, are the absolute most likely to create a shift mid-lease. If you're in this class, you are definitely not alone.

Financial Penalties Top the List

Probably the most immediate matter tenants have could be the economic impact. Survey benefits suggest that 65 per cent of landlords charge some kind of early termination charge, which could range from the charge of a single month's lease to the total book remaining in your agreement. Around 28 per cent of tenants interviewed claimed they overlooked these charges, ultimately causing shock costs that collection back their budgets.

Concealed Costs and Different Expenses

It's not just about termination fees. Some landlords also withhold protection remains or charge for re-listing the property. Normally, tenants can lose yet another 20 per cent of their deposit if the house needs cleaning or repairs after an early exit. Knowing these results can help with decision making before offering notice.

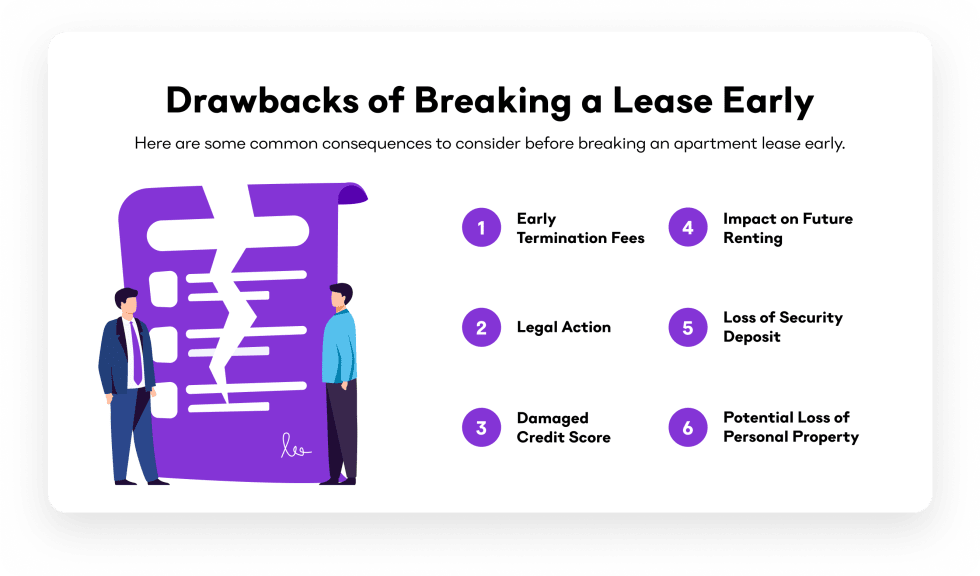

Appropriate and Credit Effects

Breaking a lease may follow you in more methods than one. Almost 22 percent of renters who broke their leases without discussing noted a reduction for their credit report. Landlords can send your unpaid balances to libraries, rendering it harder to rent elsewhere or protected loans. Moreover, being sued for unpaid rent is a actual, if less popular, risk.

Adequate Causes and Negotiations

Not totally all lease pauses are handled equally. The most commonly accepted reasons include wellness and protection violations, military arrangement, or significant home damage from functions like organic disasters. Over fifty percent of tenants polled properly negotiated with their landlords for a decreased charge or easier phrases when they offered documentation for such reasons.

The Communication Element

Data suggests that visitors who communicated early and openly using their landlords could actually save your self on average 35 % on penalty costs. Placing objectives, sharing documentation, and arranging for an alternative tenant can all lessen the fallout. The sooner you begin the conversation, the better your chances to decrease costs and defend your credit score.

What the Traits Tell Us

Lease-breaking is clearly trending upward. However, the chance of sudden charges and legitimate trouble stays high for people who do not approach ahead. Researching your lease contract, understanding the great printing, and seeking legal services if needed are clever first steps.

Studying lease-breaking data can provide renters a better picture of what's at stake, rendering it easier to consider their possibilities and avoid financial missteps. Being organized and positive turns what is actually a major setback into a well-managed transition. Report this page